top of page

The definitive source of private markets intelligence.

Australia's Private Credit Market Shows Critical Gaps in Investor Protection

According to a comprehensive report by Richard Timbs and Nigel Williams for the Australian Securities and Investments Commission, Australia's rapidly growing $200 billion private credit market exhibits significant operational deficiencies, particularly in real estate-focused funds targeting retail investors. The report reveals widespread conflicts of interest, opaque fee structures, and inconsistent valuation practices that potentially disadvantage investors while benefiting

Sep 222 min read

Private Capital Targets $7 Trillion Data Center Boom

According to Blue Owl Capital's latest whitepaper, private capital firms are positioning themselves as essential partners in financing the AI-driven infrastructure boom, with data center capital expenditure in North America projected to reach nearly $7 trillion by 2030. The investment firm argues that traditional capital markets are straining under unprecedented AI-related spending, creating opportunities for alternative financing through build-to-suit development and sale-le

Sep 162 min read

Tech Infrastructure Becomes Strategic Weapon For Asset Managers

Private markets firms face a critical technology architecture decision that will determine their ability to compete as the industry undergoes massive structural changes including retailization, insurance partnerships, and new product launches.

Sep 144 min read

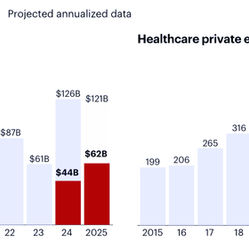

Healthcare PE Deals Slow as Tariffs Dampen Investor Appetite, Bain Report Shows

Healthcare PE deals slow amid tariff fears, but AI-driven IT assets surge as investors seek policy-insulated growth opportunities.

Sep 92 min read

US Tariffs Hit Near-Century High, Disrupt Private Markets, PitchBook Analysis Shows

US tariff surge to 100-year high disrupts private markets recovery as exit drought persists despite macro support.

Sep 72 min read

UK Private Capital Shows Resilience Despite Exit Challenges

UK private capital adapts to exit constraints with US investment surge and secondary market growth reshaping liquidity strategies.

Sep 72 min read

Private Equity Giants Surge Despite Economic Uncertainty Per Pitchbook Analysis

What's New According to PitchBook's Q2 2025 US Public PE and GP Deal Roundup , major private equity firms deployed $21 billion in...

Aug 282 min read

European VC Valuations Hit Multi-Year Highs Amid Mixed Signals, PitchBook Analysis Shows

According to PitchBook's Q2 2025 European VC Valuations Report, median venture capital valuations across Europe continued climbing in the first half of 2025, with Series E+ companies reaching €1.2 billion for the first time since 2022. The value-over-volume dynamic persisted as deal counts remained flat while median deal sizes and valuations grew across most funding series, though volatility in financial markets and geopolitical tensions created uncertainty for the second hal

Aug 252 min read

PE Secondary Market Hits Record $160B as Liquidity Drought Persists, StepStone Says

The private equity secondary market shattered records in 2024, reaching $160 billion in transaction volume as limited partners and general partners turned to alternative liquidity solutions amid a prolonged distribution drought. According to StepStone Group's August 2025 report, the first half of 2025 has already seen $102 billion in transactions, putting the market on track to break last year's record again.

Aug 232 min read

Private Markets See Q3 Rebound Amid Policy Shifts, Partners Group Says

Private markets are experiencing a "quarter of adjustment" with higher tariffs, lower interest rates, and increased policy clarity driving renewed activity. According to Partners Group's Q3 2025 Private Markets Chartbook, deal volumes are rebounding from 2024 lows as trade negotiations provide greater economic certainty and Federal Reserve rate cuts support portfolio company financing costs.

Aug 172 min read

Private Equity Fundraising Slumps to 5-Year Low in 2025

Global private equity fundraising is on track for its weakest year since 2020 — and lowest fund count in over a decade — with just $224.9B raised across 248 vehicles by midyear, according to KPMG’s Pulse of Private Equity Q2’25. The slowdown reflects muted exit activity in recent years, as GPs struggle to return capital to LPs and face tougher fundraising conditions.

Aug 142 min read

AI Infrastructure Becomes Private Equity’s New Power Play in 2025

What’s New Private equity is making billion-dollar bets on the backbone of artificial intelligence — from hyperscale data centers to...

Aug 142 min read

Continuation Vehicles Surge Amid Stalled Private Equity Exits in 2025

Private equity firms are leaning heavily on continuation vehicles (CVs) in 2025 to hold onto high-quality assets longer, according to KPMG’s Pulse of Private Equity Q2’25. With exit markets weak — particularly for IPOs and secondary buyouts — GPs are opting to roll prized portfolio companies into new funds rather than sell at a discount. LPs, however, are pushing back over valuation transparency and the risk of “stranded” assets.

Aug 142 min read

Private Equity Slows Sharply in Q2 2025 as Tariff Uncertainty Bites

Global private equity dealmaking plunged in Q2 2025, with total announced investment dropping to $363.7B across 3,769 deals, the lowest volume since Q3 2020, according to KPMG’s Pulse of Private Equity Q2’25. The slowdown was most pronounced in Asia and the Americas, as investors delayed deals pending clarity on U.S. tariff policies — despite blockbuster U.S. transactions like Blackstone’s $11.5B TXNM Energy buyout.

Aug 132 min read

Private Equity Pivots to Organic Growth Amid Market Freeze

Private equity firms are abandoning traditional value creation playbooks in favor of organic growth strategies as prolonged high interest rates and extended exit timelines force a fundamental industry transformation. According to Alvarez & Marsal's inaugural North American survey of 50 PE investors and portfolio executives, firms are implementing comprehensive operational improvements and AI-powered initiatives across portfolio companies rather than relying on multiple expans

Jul 303 min read

European PE Market Stalls as Trump Tariff Threats Disrupt Deal Flow, PitchBook Report Shows

European private equity deal value dropped 10.5% quarter-over-quarter in Q2 2025 as sponsors worldwide hit the pause button following US President Donald Trump's tariff announcements in April. According to PitchBook's European PE Breakdown, the market showed resilience in deal count, which rose 3.1% QoQ, thanks to a pickup in activity toward quarter-end as European central banks maintained monetary easing trajectories.

Jul 132 min read

Specialist VCs Outpace Generalists in Key Metrics Despite Returns Convergence

Specialist VCs drive higher valuations and faster exits but fund returns converge with generalists, reshaping investment strategies.

Jul 132 min read

PitchBook's Private Markets Benchmarks Show Mixed Q1 Performance Amid Global Uncertainty

According to PitchBook's Global Benchmarks report, private capital markets delivered a modest 0.47% return in Q1 2025, with significant divergence across asset classes as venture capital posted negative returns while private debt led performance gains.

Jul 132 min read

Blackstone's Jon Gray on AI Revolution and Market Outlook

Blackstone's President and COO Jon Gray warns that while current tariff-induced uncertainty creates short-term market volatility, the real transformation lies in artificial intelligence reshaping entire industries and driving unprecedented demand for data infrastructure.

Jul 114 min read

UK Private Markets Poised for £50bn Capital Unlock

What's New The UK is implementing sweeping reforms to channel private market investments into domestic growth, with the Mansion House...

Jul 22 min read

bottom of page