State Street Report: Private Markets Betting On Retail Access And GenAI

- Editor

- Jun 7, 2025

- 5 min read

In Brief:

State Street's fourth annual Private Markets Study, led by Global Head of Alternatives Scott Carpenter, reveals a seismic shift in how institutional investors view the future of private markets. Based on a Q1 2025 survey of nearly 500 senior executives at buyside investment institutions globally, the research identifies three interconnected trends accelerating at unprecedented speed: democratization of private markets access, an intensified focus on investment quality over quantity, and widespread adoption of AI for unstructured data analysis. Against the backdrop of renewed economic uncertainty from US tariff policies, Carpenter and his team find that 55% of respondents now believe at least half of private markets fundraising will come through semi-liquid retail-style vehicles within just two years—a dramatic acceleration from previous expectations that signals the industry's most significant structural transformation in decades.

Big Picture Drivers:

Democratization: The shift from institutional-only access to retail-friendly investment vehicles is accelerating faster than anticipated, driven by product innovation and regulatory changes.

Quality Focus: Rising interest rates and economic uncertainty have entrenched a "less is more" approach, with institutions prioritizing fewer, higher-quality investments over volume.

Technology Adoption: AI and large language models are becoming essential tools for analyzing unstructured data, with 83% of institutions recognizing their value for private markets operations.

Geopolitical Uncertainty: US tariff policies and trade tensions are creating both challenges and opportunities for private markets, influencing investment flows and regional allocation strategies.

Key Topics Covered:

Retail Fund Growth: Expectations for semi-liquid retail-style vehicles to dominate private markets fundraising within 1-2 years, with general partners more bullish than limited partners.

Regional Allocation Shifts: Significant movement away from emerging markets toward developed markets, particularly Europe, as institutions seek stability amid economic uncertainty.

AI Implementation: Widespread planning and early adoption of generative AI for portfolio management, due diligence, and data analysis across private markets operations.

Asset Class Performance: Private equity and private debt leading democratization trends, while infrastructure and real estate benefit from macro hedging characteristics.

By The Numbers:

55% of respondents now expect at least half of private markets fundraising to come through semi-liquid retail-style vehicles within two years, up from just 14% last year

83% of institutions recognize the value of GenAI-based large language models to generate analyzable data from unstructured information across their private markets operations

69% of institutions plan to increase their technology spending for data management over the next one to two years, with only 1% planning decreases

63% of limited partners now plan investments in developed Europe over the next two years, surging from 43% in 2024 as institutions flee emerging market risk

82% of respondents planning to increase private debt allocations cite attractive return and yield opportunities as their primary motivation

GenAI Insights:

Implementation Acceleration: Technology adoption has moved beyond hypothetical planning, with 33% of institutions already using AI to generate consistent, analyzable data from unstructured information while 41% are actively investing in these capabilities.

Portfolio vs Holdings Complexity: Portfolio-level data analysis presents greater challenges than individual holdings for both general partners and limited partners, with 42% of LPs reporting major difficulties with both data types compared to 35% of GPs.

Scale-Based Adoption: Large organizations with over $100 billion in assets under management are twice as likely to currently deploy AI technologies as the overall respondent base, though mid-sized firms are leveraging agility advantages.

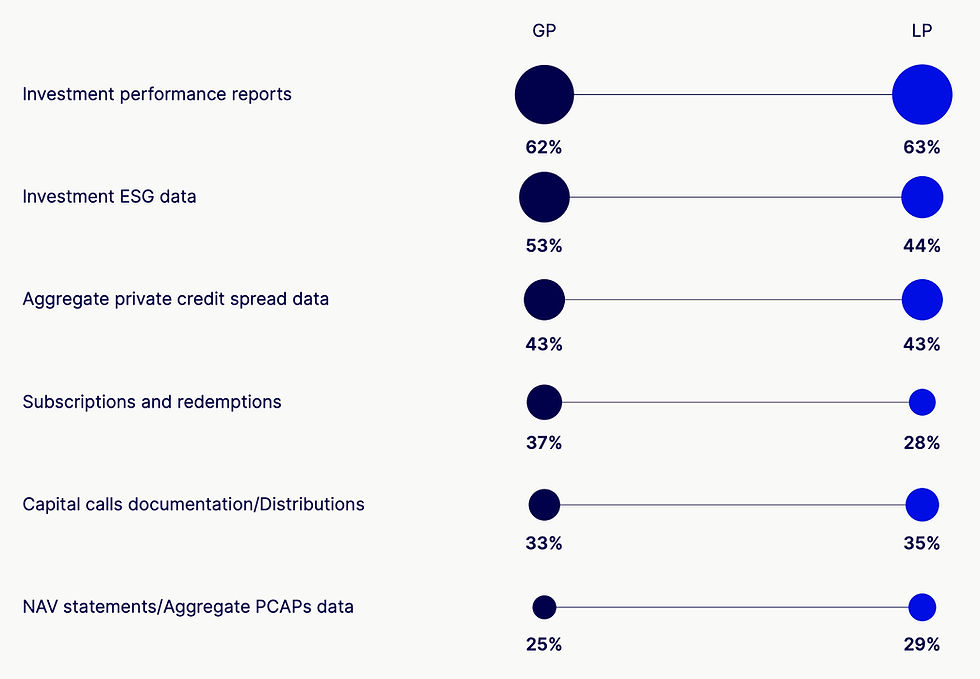

Operational Use Cases: Performance analysis dominates AI applications across both portfolio and holdings levels, with 62-63% of respondents identifying investment performance reports as the most useful application area.

Data Liquidity Foundation: AI-driven unstructured data analysis is becoming essential infrastructure for democratization efforts, as portfolio liquidity increasingly depends on data liquidity capabilities.

Key Insights:

Retail Transformation: The majority of respondents (55%) now expect at least half of private markets flows to come through quasi-retail products within two years, representing a fundamental shift from traditional institutional fundraising models.

Geographic Risk Adjustment: Investment interest in developed Europe jumped dramatically from 43% to 63% year-over-year, while emerging Asia Pacific declined from 25% to 14%, reflecting a clear flight to quality amid global uncertainty.

AI Adoption Acceleration: Technology spending for data management increased for 69% of institutions, with 33% already using AI/LLMs to generate analyzable data from unstructured information, up from just 58% seeing value in the technology last year.

Asset Allocation Stability: Despite continued growth expectations, private markets allocation plans have leveled off at 42% of portfolios within 3-5 years, suggesting the industry's shift toward quality over quantity is now entrenched.

Performance Drivers: Private debt emerges as the standout performer with 82% of respondents citing attractive returns, while macro hedging considerations drive 37% of infrastructure investment decisions.

Scale Advantages: Large organizations with $100+ billion in assets under management are twice as likely to currently use AI as smaller firms, though mid-sized players ($10-50 billion) are showing surprising agility in adoption rates.

GenAI Insights:

Implementation Acceleration: Technology adoption has moved beyond hypothetical planning, with 33% of institutions already using AI to generate consistent, analyzable data from unstructured information while 41% are actively investing in these capabilities.

Portfolio vs Holdings Complexity: Portfolio-level data analysis presents greater challenges than individual holdings for both general partners and limited partners, with 42% of LPs reporting major difficulties with both data types compared to 35% of GPs.

Scale-Based Adoption: Large organizations with over $100 billion in assets under management are twice as likely to currently deploy AI technologies as the overall respondent base, though mid-sized firms are leveraging agility advantages.

Operational Use Cases: Performance analysis dominates AI applications across both portfolio and holdings levels, with 62-63% of respondents identifying investment performance reports as the most useful application area.

Data Liquidity Foundation: AI-driven unstructured data analysis is becoming essential infrastructure for democratization efforts, as portfolio liquidity increasingly depends on data liquidity capabilities.

Memorable Quotes:

"The power of ETFs is in providing access to investors who would not have had that access otherwise. When you bring it to retail clients, that's where the real power of the ETF wrapper comes into play." - Anna Paglia, State Street Global Advisors Chief Business Officer, explaining the democratization strategy behind private assets ETFs.

"I see GenAI having an outsized impact within private markets because so much of our data is unstructured — it lives in PowerPoint, Excel and text documents — precisely where GenAI is the strongest." - Anonymous GP participant, describing AI's transformative potential in private markets operations.

"Product innovation in the semi-liquid fund space" - Survey respondents identified this as the top factor (44%) for driving private markets democratization, emphasizing bottom-up industry solutions.

"The renewed uncertainty of global economic output coming from the US tariff policies... is likely to make institutions more selective in their investments." - Report authors, connecting geopolitical developments to investment strategy shifts.

"Portfolio liquidity begins with data liquidity" - Report conclusion, linking AI adoption to democratization success in making private markets more accessible to individual investors.

The Wrap:

State Street's research captures private markets at an inflection point where technological capabilities, regulatory evolution, and economic pressures are converging to reshape the industry's fundamental structure. The accelerating timeline for retail access, combined with AI-driven operational improvements and a flight to quality amid geopolitical uncertainty, suggests the next two years will be transformative for how private markets operate and serve investors. While democratization promises to expand the investor base dramatically, the industry's simultaneous focus on technology and quality suggests this expansion will be built on more sophisticated, data-driven foundations than previous market cycles.

Comments