Private Markets Navigate "Shifting Weather" as Industry Evolves Beyond Traditional Funds, McKinsey Says

- Editor

- May 22, 2025

- 2 min read

Updated: May 22, 2025

What's New

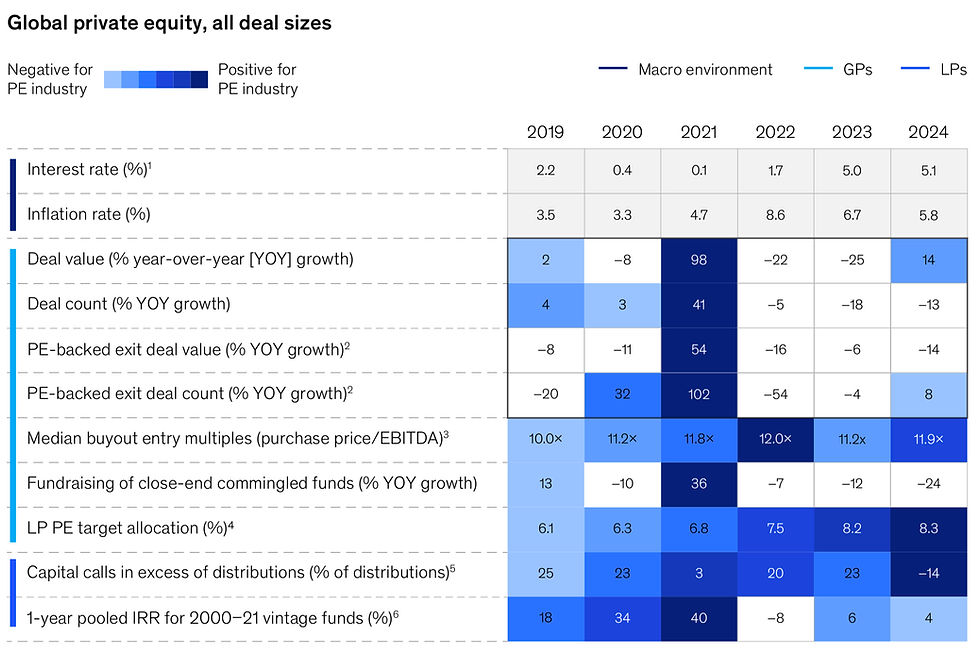

Private equity is emerging from a challenging period with distributions finally exceeding capital contributions for the first time since 2015, while global deal value rebounded 14% to $2 trillion in 2024. According to McKinsey's Global Private Markets Report 2025, this marks the beginning of recovery after three years of difficult conditions caused by rising interest rates and economic uncertainty.

Why It Matters

The private markets industry, managing approximately $22 trillion in assets when including alternative capital sources, is showing signs of resilience and adaptation. As traditional fundraising faces headwinds, managers are innovating with new vehicle structures and tapping retail investors, while LPs increasingly seek liquidity solutions through secondaries markets that hit record highs.

Big Picture Drivers

Rate Environment: Declining financing costs and monetary easing enabled sponsors to increase leverage and pursue larger deals after years of expensive capital

Exit Pressure: Historic backlog of 18,000+ companies held beyond four years creates urgency for distributions, with LPs prioritizing cash returns over paper gains

Capital Innovation: Alternative funding sources including insurance capital, retail access, and separately managed accounts now represent nearly $8 trillion in additional AUM

Operational Focus: Rising entry multiples and longer hold periods force managers to emphasize active value creation over financial engineering

Market Maturation: Industry consolidation continues with top 100 GPs making 3x more acquisitions than previous five-year period

By The Numbers

$162 billion: Record secondaries transaction volume in 2024, up 45% year-over-year as liquidity demand surges

61%: Share of buyout companies held beyond four years, the highest percentage in two decades

89%: Secondaries pricing as percentage of net asset value, up from 85% in 2023, making exits more attractive

6.7 years: Average buyout holding period, one full year above the 20-year average of 5.7 years

$7-8 trillion: Estimated alternative capital sources beyond traditional closed-end funds, representing 33% of total AUM

Key Trends to Watch

Retail Democratization: Regulatory changes and new fund structures are opening $60 trillion retail market to private capital investment opportunities.

Data Center Surge: AI-driven demand could triple data center power requirements to 219 gigawatts by 2030, creating massive infrastructure investment needs.

GP Stakes Growth: 43% of surveyed LPs now invest in GP stakes funds, with sovereign wealth funds showing particular interest in direct manager ownership.

Credit Expansion: Private debt managers are moving beyond traditional lending into infrastructure, real estate, and asset-backed finance as banks retreat under regulatory pressure.

The Wrap

Private markets are evolving from a traditional asset class into a more diverse ecosystem encompassing retail access, permanent capital, and innovative structures. While challenges remain around exits and valuations, the industry's adaptation through new capital sources and operational excellence positions it for continued growth despite shifting macroeconomic conditions.

Comments