top of page

The definitive source of private markets intelligence.

Blackstone Declares 'Deal Dam Breaking' as Record $1.24 Trillion AUM Caps 40th Anniversary Quarter

What's Happening Blackstone delivered its third quarter 2025 earnings amid its 40th anniversary celebration, with management declaring the long awaited "deal dam" is finally breaking as capital markets activity resurges and multiple secular growth engines accelerate simultaneously. The quarter demonstrated the firm's unique positioning at the intersection of cyclical recovery and structural transformation in alternatives, with private wealth, insurance, and institutional chan

9 hours ago5 min read

Private Markets Surge as Investors Seek Diversification | HSBC Outlook

Private capital hits $22T as investors flee broken stock-bond correlation; Q3 2025 PE deals reach highest since Q4 2021.

Jan 22 min read

Goldman Sachs Summit Signals 2026 Dealmaking Surge

According to Goldman Sachs Asset Management's 2025 Alternatives Summit, corporate M&A volumes in 2025 are expected to match 2021 levels, with IPO markets showing significant recovery despite earlier tariff impacts. The October gathering brought together leaders including former Treasury Secretary Steven Mnuchin and former UK Prime Minister Rishi Sunak, who delivered a stark warning that the next decade will be "the most dangerous and transformational of our lifetime."

Nov 26, 20252 min read

Tech Investors Face New Reality as Easy Software Wins End

Bain & Company's Technology Report 2025 reveals that technology deals increased their share of all buyouts to 22% in the first half of 2025, up from 19% at year-end 2024, but the era of easy returns from simply riding software growth is ending. Private equity investors must fundamentally shift their value creation strategies as software market penetration flattens and traditional revenue sources lose steam.

Nov 2, 20252 min read

US Private Equity Surges 38% YoY Despite Fundraising Headwinds

According to PitchBook's Q3 2025 US PE Breakdown, private equity deal activity posted strong quarterly growth with $331.1 billion across 2,347 transactions in Q3 2025—a 28% sequential increase and 38% year-over-year gain. The resurgence follows a brief Q2 air pocket and comes as recession risk drops below 10%, Federal Reserve rate cuts take effect, and major indices reach new highs.

Nov 2, 20253 min read

Private Markets at a Crossroads as Retail Push Collides With Quality Concerns | Weekly Pulse

Private markets face a critical moment as the rush to open alternative investments to retail investors collides with mounting concerns over credit quality, transparency, and regulatory oversight. BDC stocks are plunging, dividends are being cut for the first time, and high-profile bankruptcies are exposing risks in the $1.7 trillion sector.

Oct 11, 20256 min read

Private Capital Powers New Era Of Megadeals

Private credit convergence enables $70B LBOs while PE firms innovate exits for $3.9T in unrealized portfolio value.

Oct 4, 20256 min read

Private Markets Surge Amid Structural Shifts | Weekly Pulse

Must Know: Record Deal Activity Signals Private Markets Renaissance Bottom Line: Electronic Arts' $55 billion leveraged buyout—the...

Oct 4, 20256 min read

Permira's Co-CEOs on Building Tech-Forward Giants

Private equity has evolved from leveraging quirky businesses to commanding the most valuable companies across every sector, with technology investments now representing the frontier of value creation. Brian Ruder and Dipan Patel, Co-CEOs of Permira, reveal how their €80 billion firm has transformed from traditional buyout investing to growth-oriented technology leadership during their conversation with Michael Sidgmore on the Alt Goes Mainstream podcast at the firm's London o

Sep 27, 20253 min read

Private Equity Industry Hits Historic Low Amid Deal Drought

Private equity is experiencing its worst slump in decades, with quarterly returns plummeting from 13.5% in 2021 to just 8% by late 2024, creating a crisis where firms can't exit investments, return capital to investors, or raise new funds effectively. The industry's traditional model of buying, improving, and selling companies for profit has ground to a halt amid higher interest rates, frozen exit markets, and economic uncertainty, leaving firms sitting on $1.2 trillion in un

Sep 27, 20252 min read

Brookfield Asset Management Targets Dramatic Growth Through AI and Private Wealth at Investor Day

Brookfield Asset Management executives outlined an ambitious plan to double the firm's size over the next five years, targeting compound earnings growth of up to 20% annually through strategic expansion into artificial intelligence infrastructure and private wealth markets. Speaking at their 2025 Investor Day in New York, CEO Bruce Flatt, President Connor Teskey along with key senior executives positioned the $1 trillion asset manager to capitalize on what they see as transfo

Sep 27, 20253 min read

Private Equity Faces Historic Reckoning as Fundraising Slowdown Deepens | Weekly Pulse

Private equity faces its worst crisis in decades as fundraising collapses and exit strategies fail. Over 18,000 funds chase $3.3 trillion while returns plummet from 13.5% to 0.8%. Firms explore retail democratization and continuation funds as traditional models break down across global markets.Retry

Sep 27, 20254 min read

Private Credit Outpaces Traditional Asset Managers in Retail Race | Weekly Pulse

Must Know: Private Credit Surges as Traditional Asset Managers Struggle to Keep Pace Bottom Line: Private credit firms are rapidly...

Sep 19, 20255 min read

Exit Bottleneck Drives Record PE Self-Sales as Liquidity Routes Blocked | Weekly Pulse

Private equity firms sold $41bn of companies back to themselves in H1 2025 as exit routes stay blocked. With $3tn in stranded assets and rising "zombie fund" predictions, firms turn to continuation vehicles while pension funds retreat from private credit amid quality concerns and regulatory scrutiny intensifies globally.

Sep 14, 20254 min read

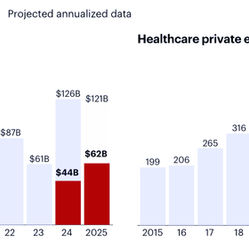

Healthcare PE Deals Slow as Tariffs Dampen Investor Appetite, Bain Report Shows

Healthcare PE deals slow amid tariff fears, but AI-driven IT assets surge as investors seek policy-insulated growth opportunities.

Sep 9, 20252 min read

US Tariffs Hit Near-Century High, Disrupt Private Markets, PitchBook Analysis Shows

US tariff surge to 100-year high disrupts private markets recovery as exit drought persists despite macro support.

Sep 7, 20252 min read

Secondaries Surge as Liquidity Crunch Drives Innovation | Weekly Pulse

Private credit secondaries explode to $18B as liquidity crunch hits funds. Goldman invests $1B in T. Rowe for retail push. Major deals: $38B Oracle data centers, $20B Carlyle secondaries fund. Asia education boom driven by Apollo/KKR. Industry consolidation expected as 96% of managers anticipate M&A within 5 years amid regulatory pressures.Retry

Sep 7, 20254 min read

AI Poised to Transform Private Markets Investment Strategies

AI will transform private markets like Bloomberg did bonds—operational efficiency today, new investment strategies tomorrow.

Aug 31, 20252 min read

Wealthy Individual Investors Fuel $48B Private Credit Rush as PE Exit Windows Remain Shut | Weekly Pulse

Wealthy Americans drove record $48B into private credit in H1 2025, offsetting institutional pullback. Major deals included Thoma Bravo's $2.7B Verint financing & Apollo's $3.5B Aspen exit. TPG faced healthcare scrutiny while regulators tightened oversight globally. Venture debt hit $53B record as firms target mature companies amid prolonged private periods.

Aug 31, 20254 min read

PE Firms Battle Eight-Year Exit Timeline While Investor Distribution Pressure Mounts | Weekly Pulse

Private equity faces historic crisis: 30,000+ portfolio companies need 8 years to exit at current pace. Despite $29B Meta deal & $10B Warburg returns, PE stocks trail S&P 500 as LP pressure mounts. Exit drought drives "private for longer" revolution via continuation vehicles. Critics warn retail 401(k) access inappropriate amid inventory bottleneck.

Aug 23, 20254 min read

bottom of page