top of page

The definitive source of private markets intelligence.

EQT Founder: Politics Biggest Investment Risk Today

Political risk has emerged as the single greatest threat to global investing, surpassing traditional market concerns like valuations or economic cycles. Conni Jonsson, Founder and Chairperson of EQT, addresses this challenge head-on in the Alt Goes Mainstream podcast's DNA series, arguing that geographic diversification represents the only viable mitigation strategy in an increasingly unstable political environment.

Oct 26, 20254 min read

Blackstone Defends Private Credit Playbook Amid Market Scrutiny as Realizations Double

Blackstone Q3 2025: Distributable earnings surge 50% to $1.9B on realizations doubling, record $1.24T AUM driven by $54B quarterly inflows. Management forcefully defends $150B direct lending platform (95%+ senior secured, 38% LTV) against market scrutiny of bank-led credit defaults while highlighting capital markets recovery with IPO pipeline set for potential historic year and real estate inflection signals emerging.

Oct 23, 20256 min read

BlackRock Bets Big on Private Markets Integration as HPS Deal Reshapes Alternative Asset Strategy

BlackRock delivered its third quarter 2025 earnings against the backdrop of a transformative shift in its business model, with the recently closed HPS Investment Partners acquisition immediately contributing to results and signaling the firm's aggressive push beyond its public markets heritage into private credit and infrastructure. The quarter showcased early momentum from the integration strategy, with private markets deployment velocity exceeding expectations.

Oct 23, 20257 min read

Orlando Bravo's Private Equity Playbook Revealed

Orlando Bravo, founder and managing partner of Thoma Bravo—the world's largest software-focused private equity firm managing $179 billion in assets—shared his formula for building one of the industry's best-performing firms at the All-In Summit 2025.

Oct 22, 20253 min read

Private Markets at a Crossroads as Retail Push Collides With Quality Concerns | Weekly Pulse

Private markets face a critical moment as the rush to open alternative investments to retail investors collides with mounting concerns over credit quality, transparency, and regulatory oversight. BDC stocks are plunging, dividends are being cut for the first time, and high-profile bankruptcies are exposing risks in the $1.7 trillion sector.

Oct 11, 20256 min read

Hg's Chris Kindt on AI Transforming Private Equity Value Creation

Private equity value creation is experiencing its most significant transformation in decades as artificial intelligence shifts from efficiency tool to fundamental business reinvention. Chris Kindt, Partner and Head of Value Creation at Hg, warns that companies failing to embrace "AI-first" culture risk falling on the wrong side of disruption as agentic AI delivers 10-20x efficiency gains in core functions.

Oct 8, 20254 min read

Brookfield Bets Big On AI Infrastructure

Artificial intelligence infrastructure will require over $7 trillion in capital investment over the next decade—nearly ten times the $800 billion spent on internet fiber buildout—but grid capacity shortages rather than capital availability now threaten to constrain AI adoption, forcing a fundamental geographic inversion where training workloads move to remote power sources while inference demands urban proximity.

Oct 4, 20254 min read

Private Markets Surge Amid Structural Shifts | Weekly Pulse

Must Know: Record Deal Activity Signals Private Markets Renaissance Bottom Line: Electronic Arts' $55 billion leveraged buyout—the...

Oct 4, 20256 min read

AI Drives Private Equity's Next Competitive Edge

Private equity faces mounting pressure to deliver returns after years of overpriced deals and sluggish exits, forcing firms to fundamentally rethink how they create value in an increasingly competitive landscape. Clark O'Neill, BCG's global lead for AI infrastructure and cyber in the private investors and private equity practice, argues that artificial intelligence has moved beyond theoretical potential to become a practical necessity for differentiated returns.

Oct 2, 20253 min read

Private Equity Industry Hits Historic Low Amid Deal Drought

Private equity is experiencing its worst slump in decades, with quarterly returns plummeting from 13.5% in 2021 to just 8% by late 2024, creating a crisis where firms can't exit investments, return capital to investors, or raise new funds effectively. The industry's traditional model of buying, improving, and selling companies for profit has ground to a halt amid higher interest rates, frozen exit markets, and economic uncertainty, leaving firms sitting on $1.2 trillion in un

Sep 27, 20252 min read

Private Equity Faces Historic Reckoning as Fundraising Slowdown Deepens | Weekly Pulse

Private equity faces its worst crisis in decades as fundraising collapses and exit strategies fail. Over 18,000 funds chase $3.3 trillion while returns plummet from 13.5% to 0.8%. Firms explore retail democratization and continuation funds as traditional models break down across global markets.Retry

Sep 27, 20254 min read

Blackstone's Gray: AI Revolution Drives Investment Boom

Jon Gray warns that artificial intelligence represents "the main thing" driving a new industrial revolution that will fundamentally reshape the global economy, creating massive investment opportunities while threatening to displace entire industries within years. The President and COO of Blackstone, the world's largest alternative asset manager with $1.2 trillion under management, delivered this assessment to investors at the firm's 2025 CIO Symposium.

Sep 26, 20253 min read

Private Credit Outpaces Traditional Asset Managers in Retail Race | Weekly Pulse

Must Know: Private Credit Surges as Traditional Asset Managers Struggle to Keep Pace Bottom Line: Private credit firms are rapidly...

Sep 19, 20255 min read

Exit Bottleneck Drives Record PE Self-Sales as Liquidity Routes Blocked | Weekly Pulse

Private equity firms sold $41bn of companies back to themselves in H1 2025 as exit routes stay blocked. With $3tn in stranded assets and rising "zombie fund" predictions, firms turn to continuation vehicles while pension funds retreat from private credit amid quality concerns and regulatory scrutiny intensifies globally.

Sep 14, 20254 min read

Nordic Capital's Healthcare Investment Strategy Shifts

Healthcare costs now consume up to 20% of U.S. GDP and are growing at twice the rate of inflation, creating what one private equity executive calls a "national security issue" that threatens America's spending power on defense and other priorities. Daniel Berglund, Head of U.S. and Co-Head of Healthcare at Nordic Capital, argues that this unsustainable trajectory demands a fundamental shift toward technology-driven solutions and value-based care models.

Sep 11, 20253 min read

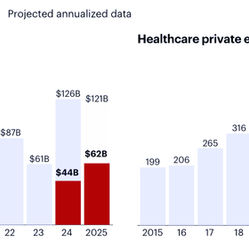

Healthcare PE Deals Slow as Tariffs Dampen Investor Appetite, Bain Report Shows

Healthcare PE deals slow amid tariff fears, but AI-driven IT assets surge as investors seek policy-insulated growth opportunities.

Sep 9, 20252 min read

UK Private Capital Shows Resilience Despite Exit Challenges

UK private capital adapts to exit constraints with US investment surge and secondary market growth reshaping liquidity strategies.

Sep 7, 20252 min read

Secondaries Surge as Liquidity Crunch Drives Innovation | Weekly Pulse

Private credit secondaries explode to $18B as liquidity crunch hits funds. Goldman invests $1B in T. Rowe for retail push. Major deals: $38B Oracle data centers, $20B Carlyle secondaries fund. Asia education boom driven by Apollo/KKR. Industry consolidation expected as 96% of managers anticipate M&A within 5 years amid regulatory pressures.Retry

Sep 7, 20254 min read

Wealthy Individual Investors Fuel $48B Private Credit Rush as PE Exit Windows Remain Shut | Weekly Pulse

Wealthy Americans drove record $48B into private credit in H1 2025, offsetting institutional pullback. Major deals included Thoma Bravo's $2.7B Verint financing & Apollo's $3.5B Aspen exit. TPG faced healthcare scrutiny while regulators tightened oversight globally. Venture debt hit $53B record as firms target mature companies amid prolonged private periods.

Aug 31, 20254 min read

Alternative Asset Managers Embrace Insurance in $1 Trillion Transformation

Asset managers acquire $1T in insurance products, transforming from episodic fundraising to permanent capital with lower valuations.

Aug 28, 20253 min read

bottom of page