top of page

The definitive source of private markets intelligence.

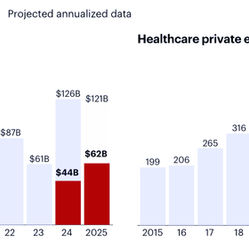

Healthcare PE Hits Record $191B in 2025 Deal Value | Bain Outlook

What's New Bain & Company's Global Healthcare Private Equity Report 2026 reveals that global healthcare private equity delivered a record-breaking performance in 2025, with disclosed deal value exceeding an estimated $191 billion—surpassing the previous high set in 2021—while deal volume hit 445 buyouts, marking the second-highest annual total on record despite a second-quarter tariff-related pause. Why It Matters The record performance signals sustained investor confidenc

Jan 102 min read

AI and Policy Reform Fuel Healthcare Renaissance | PitchBook Healthcare Outlook

What's New PitchBook's 2026 Healthcare Outlook calls this "one of the best investing opportunities we have seen in decades" across healthcare subsectors. AI is improving Phase I trial success rates from ~52% to ~80%, potentially more than doubling overall approval likelihood—with early-stage assets that have been "capital-deprived" offering the greatest return profiles. Why It Matters After pandemic-induced capital misallocation, healthcare is structurally de-risking. The r

Dec 31, 20252 min read

Nordic Capital's Healthcare Investment Strategy Shifts

Healthcare costs now consume up to 20% of U.S. GDP and are growing at twice the rate of inflation, creating what one private equity executive calls a "national security issue" that threatens America's spending power on defense and other priorities. Daniel Berglund, Head of U.S. and Co-Head of Healthcare at Nordic Capital, argues that this unsustainable trajectory demands a fundamental shift toward technology-driven solutions and value-based care models.

Sep 11, 20253 min read

Healthcare PE Deals Slow as Tariffs Dampen Investor Appetite, Bain Report Shows

Healthcare PE deals slow amid tariff fears, but AI-driven IT assets surge as investors seek policy-insulated growth opportunities.

Sep 9, 20252 min read

Wealthy Individual Investors Fuel $48B Private Credit Rush as PE Exit Windows Remain Shut | Weekly Pulse

Wealthy Americans drove record $48B into private credit in H1 2025, offsetting institutional pullback. Major deals included Thoma Bravo's $2.7B Verint financing & Apollo's $3.5B Aspen exit. TPG faced healthcare scrutiny while regulators tightened oversight globally. Venture debt hit $53B record as firms target mature companies amid prolonged private periods.

Aug 31, 20254 min read

Private Equity's Healthcare Problem Gets Worse

Private equity firms are facing mounting evidence that their healthcare investments prioritize profits over patients, with new investigations revealing dangerous practices at hospitals from Massachusetts to Pakistan.

Aug 26, 20252 min read

Private Markets Face Growth Crossroads as 401(k) Access Opens | Weekly Pulse

Private markets face historic transformation as traditional institutional fundraising hits multi-year lows while Trump's executive order opens $12.2 trillion retirement market. Major firms like Apollo, Carlyle pivot to retail channels and evergreen funds as geographic shifts accelerate from UK tax exodus to Asia expansion.RetryClaude can make mistakes. Please double-check responses.

Aug 10, 20254 min read

Private Markets Shift to Retail as Institutional Flows Slow While Managing Risk Concerns | Weekly Pulse

Private markets pivot to retail investors as institutional capital slows, while firms push higher leverage ratios to compete. Major fundraising milestones include Haveli's record $4.5B debut fund and iCapital's $820M raise. Banks fight PE talent poaching with new policies. Global PE deal value up 18.7% to $386B in H1 despite fewer transactions.

Jul 12, 20254 min read

Escala Secures $4.5M in Funding to Accelerate Global Expansion of FDA-Approved Medical Device

Escala Medical raises $4.5M to expand its FDA-approved pelvic organ prolapse treatment device globally, including EIC Fund investment.

Jun 30, 20252 min read

Gallant Raises $18M Series B for Pet Stem Cell Therapies

Gallant secures $18M Series B to advance off-the-shelf stem cell therapies for pets, targeting FDA approval for feline treatment.

Jun 30, 20252 min read

HealthpointCapital Acquires ImmersiveTouch, a Leading Extended Reality Surgical Platform

HealthpointCapital acquires majority stake in ImmersiveTouch, enhancing surgical planning and navigation with VR/AR technology.

Jun 30, 20251 min read

Halogen Ventures Closes $30M Fund to Invest in Childcare and Future of Family

Jesse Draper's VC firm raises $30M to invest in the $7.5T Future of Family market, focusing on childcare and female-founded startups.

Jun 27, 20251 min read

Legal-Bay Reports on Exactech Lawsuit Developments and Legal Options for Plaintiffs

Legal-Bay announces Exactech's decision to allow lawsuits against TPG Capital, offering new options for plaintiffs with defective implants.

Jun 27, 20251 min read

New Research: Denials Now Greatest Financial Threat to Hospitals

Knowtion Health study finds 48% of revenue cycle leaders view payer denials as top threat to financial performance.

Jun 26, 20251 min read

RAAPID's Executive RADV Audit Webinar Now Available On-Demand for Medicare Advantage Plans

RAAPID concludes webinar on RADV audit preparation, highlighting financial implications and leadership responsibilities for MA plans.

Jun 26, 20251 min read

CenterGate Capital Announces Partnership with The Marena Group

CenterGate Capital invests in The Marena Group, a leading provider of compression garments for medical and consumer markets.

Jun 26, 20251 min read

Lafayette Square Provides Financing to Support Growth of Genuine Foods

Lafayette Square provides debt financing to Genuine Foods, a foodservice management company serving K-12 schools and higher education institutions.

Jun 25, 20251 min read

PKF O'Connor Davies Welcomes Michael Curtiss as Partner

PKF O'Connor Davies adds Michael Curtiss as Partner in Advisory Practice, focusing on Transaction Advisory and Outsourced CFO Solutions.

Jun 25, 20251 min read

Avista Healthcare Partners Closes Continuation Fund for GCM

Avista Healthcare Partners closes continuation fund for GCM, backed by Goldman Sachs Alternatives and BlackRock Secondaries.

Jun 24, 20252 min read

New AI Rollouts Signal Shift From Hype to Healthcare Reality

AI adoption in healthcare is accelerating, with new tools improving diagnostics, drug discovery, and administrative workflows.

Jun 24, 20252 min read

bottom of page