top of page

The definitive source of private markets intelligence.

Private Wealth Allocations Could Quadruple Through Evergreens

Private wealth investors currently allocate just 3-5% to alternatives compared to 20-50% for institutions, representing a massive untapped opportunity that could reshape the entire asset management industry over the next decade. Peter Aliprantis, Partner and Head of Private Wealth Americas at EQT, argues that evergreen structures and improved investor education will drive this transformation.

Jul 31, 20254 min read

Blue Owl Capital Hits Record $12.1B Quarterly Fundraising as AI Infrastructure Boom Drives Unprecedented Growth

Blue Owl Capital delivered a record-breaking Q2 2025 performance with $12.1 billion in equity fundraising and $284.1 billion in AUM (up 48% YoY), marking the 17th consecutive quarter of management fee and FRE growth. The alternative asset manager continues aggressive expansion through strategic acquisitions and new product launches, positioning itself at the intersection of AI infrastructure demand and private credit markets while successfully scaling institutional and privat

Jul 31, 20254 min read

Jefferies: Credit Secondaries Market Surges as Continuation Vehicles Go Mainstream

Credit secondaries surge 70%+ annually as continuation vehicles become mainstream solution for GP-led liquidity needs.

Jul 27, 20252 min read

Carlyle CEO on Private Credit's Trillion-Dollar Rise

Private markets have exploded into a $13 trillion powerhouse as traditional banking retreats, with private credit alone tripling from $517 billion in 2015 to over $1.7 trillion today. Harvey Schwartz, CEO of Carlyle Group—one of the world's largest private equity firms managing over $450 billion—warns we're in the early days of this financial transformation, with regulators increasingly concerned about systemic risks in this largely untested shadow banking system.

Jul 27, 20253 min read

Sixth Street CEO: AI Transition Risk and Investment Evolution

Alan Waxman warns that the financial system faces significant overlooked risks from AI's productivity transition, citing insufficient discussion about job displacement and economic rebalancing as artificial intelligence reshapes entire industries.

Jul 24, 20253 min read

Blackstone Posts Record $1.2T AUM as Fee Earnings Surge 31% Despite Muted Dealmaking

Blackstone reported outstanding Q2 2025 results with distributable earnings of $1.6 billion ($1.21/share), up 25% year-over-year, while fee-related earnings surged 31% to $1.5 billion. Assets under management hit a record $1.2 trillion, up 13% YoY, driven by $52 billion in quarterly inflows and strong performance across private credit, infrastructure, and private wealth platforms despite a muted realization environment.

Jul 24, 20254 min read

Private Credit Prepares for Deal Surge as Market Bottleneck Eases

The private credit market is sitting on massive piles of capital while waiting for a significant backlog of deals to emerge once market volatility settles, creating what could be an explosive growth period for direct lenders.

Jul 19, 20254 min read

Yale Private Markets Investment Chief Warns of Permanent Return Decline

The private equity and venture capital industry faces a fundamental reckoning as the strategies that generated extraordinary returns over the past four decades become increasingly difficult to replicate, according to Tim Sullivan, who recently retired after overseeing Yale University's private market portfolios for 39 years. Sullivan warns that institutions must dramatically lower their return expectations as the industry has become overcrowded, overfunded, and efficiently pr

Jul 19, 20254 min read

Private Credit Defends Against Peak Predictions

Mike Dennis discusses how private credit proves resilient despite peak predictions, with middle-market focus offering protection from competition.

Jul 19, 20253 min read

Private Markets Embrace Policy Shifts as 401(k) Access and Regulatory Scrutiny Reshape Industry Dynamics | Weekly Pulse

Private markets face regulatory crossroads as Trump's 401(k) order promises $12.5T access while Warren scrutinizes $1.7T credit sector. Industry splits on growth outlook with Dimon warning of peaks vs. private credit leaders seeing continued expansion. Major deals include Reckitt's $4.8B sale to Advent.RetryClaude can make mistakes. Please double-check responses.

Jul 19, 20254 min read

Private Credit Market Far From Peak, Set For Massive Growth

The private credit market is nowhere near its peak despite recent warnings from major bank executives, and is instead positioned for explosive growth that could see it reach $15 trillion within a decade—matching the size of public credit markets.

Jul 18, 20253 min read

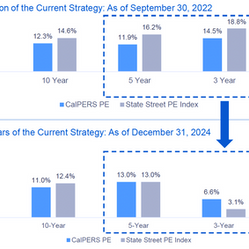

CalPERS PE Strategy Overhaul Delivers Top Returns

CalPERS Private Equity has achieved a stunning performance turnaround, catapulting from 17th place in 2022 to the top performer among America's 30 largest public pension fund private equity programs in 2024.

Jul 16, 20253 min read

Vantager Brings AI-Native Infrastructure to Private Market Allocators

Vantager launches to modernize how Limited Partners assess and act on private market fund data—delivering structure, speed, and strategic insight through AI.

Jul 15, 20253 min read

Private Equity's Continuation Fund Surge Raises Quality Concerns

Private equity's continuation fund market is experiencing explosive growth, with these vehicles now representing 13% of global PE exits in 2024, up from just 5% in 2021, according to investment bank Jefferies data reported by The Wall Street Journal. However, industry experts warn that as firms increasingly use these tools to extend asset ownership and provide liquidity to cash-starved investors, the real test lies not just in providing liquidity but in maintaining asset qual

Jul 14, 20253 min read

JPMorgan Enters Private Credit Despite Dimon's Warning, WSJ Reports

JPMorgan Chase CEO Jamie Dimon is diving headfirst into the private credit market with a $50 billion commitment, despite publicly comparing the fast-growing sector to the risky lending practices that sparked the 2008 financial crisis, according to The Wall Street Journal. The nation's largest bank is racing to compete with unregulated lending giants like Blackstone and Ares Management that have dominated this space for over a decade.

Jul 14, 20253 min read

KKR's Freise on Managing Through Multiple Market Cycles

Philipp Freise, Co-Head of European Private Equity at KKR and manager of Europe's largest private fund at $8 billion, argues that the current hangover from 2021's artificial liquidity surge is cyclical rather than structural, though resolution requires fundamental changes to how capital flows to individual investors.

Jul 13, 20253 min read

Emerging Managers Debate Scale vs. Specialization Strategy

The venture capital ecosystem is grappling with fundamental questions about optimal fund sizing as emerging managers weigh the benefits of scaling operations against maintaining focused specialization strategies. The entire Screendoor team—Lisa Cawley, Layne Johnson, and Jamie Rhode—joined the Superclusters podcast to address critical questions from three emerging GPs about LP motivations, venture transparency, and scaling decisions.

Jul 13, 20253 min read

LP of GPs Model Redefines Emerging Manager Access

The venture capital ecosystem is witnessing a fundamental transformation as innovative fund structures emerge to bridge the gap between institutional LPs and emerging managers, creating new pathways for accessing top-tier talent while they're still building their firms. Lisa Cawley, Managing Director of Screendoor, reveals how the "LP of GPs" model is revolutionizing early-stage fund investing by combining allocator expertise with seasoned GP advisory support.

Jul 13, 20253 min read

Private Credit Secondaries Leader Sees Disruption Ahead

Private credit secondaries are experiencing explosive growth as the broader $1.7 trillion private credit market creates unprecedented liquidity demands, with deal flow surging from $5-7 billion five years ago to $36 billion in 2024. Rick Jain, Partner and Global Head of Private Credit at Pantheon, warns that while opportunities abound, the market faces potential disruption from mounting macroeconomic uncertainty and overconfidence in current pricing.

Jul 12, 20253 min read

Software Investing Demands Organic Growth Over Financial Engineering, Says Seasoned Investor

Private equity firms must fundamentally shift from financial engineering to backing businesses with genuine organic growth as higher interest rates eliminate traditional return drivers like leverage and multiple arbitrage. Nic Humphries, Senior Partner and Executive Chairman of Hg, demonstrates how three decades of focused software investing has built Europe's second-largest technology conglomerate by prioritizing customer value over financial manipulation.

Jul 12, 20253 min read

bottom of page