top of page

The definitive source of private markets intelligence.

How Venture Capital Has Fundamentally Changed

Secondaries now drive 71% of VC exits as firms adapt to longer hold periods and seek strategic liquidity options.

Sep 21, 20253 min read

Private Credit Outpaces Traditional Asset Managers in Retail Race | Weekly Pulse

Must Know: Private Credit Surges as Traditional Asset Managers Struggle to Keep Pace Bottom Line: Private credit firms are rapidly...

Sep 19, 20255 min read

Emerging Managers' Biggest Risk Isn't Market Performance

The private equity industry faces a paradox where experienced professionals with decades of track records are labeled "emerging managers" simply because they're launching first-time funds.

Sep 18, 20253 min read

Venture Capital's Defense Boom Faces Return Reality Check

Defense technology venture capital investment has surged from $1 billion in 2020 to $7 billion in 2024, creating what appears to be the industry's next major theme after AI's recent dominance. However, veteran investor Alex van Someren warns that venture capital remains "one of the hardest ways to make money" and cautions against the herd mentality that periodically drives stampedes toward fashionable sectors.

Sep 18, 20253 min read

Permira Co-CEO Sees Quality Flight Reshaping Private Markets

In Brief: The private equity industry faces unprecedented complexity as multiple independent factors—higher interest rates, fractured...

Sep 18, 20253 min read

Private Capital Targets $7 Trillion Data Center Boom

According to Blue Owl Capital's latest whitepaper, private capital firms are positioning themselves as essential partners in financing the AI-driven infrastructure boom, with data center capital expenditure in North America projected to reach nearly $7 trillion by 2030. The investment firm argues that traditional capital markets are straining under unprecedented AI-related spending, creating opportunities for alternative financing through build-to-suit development and sale-le

Sep 16, 20252 min read

Tech Infrastructure Becomes Strategic Weapon For Asset Managers

Private markets firms face a critical technology architecture decision that will determine their ability to compete as the industry undergoes massive structural changes including retailization, insurance partnerships, and new product launches.

Sep 14, 20254 min read

Franklin Templeton CEO Warns on Alternatives Saturation Problem

Jenny Johnson warns that alternatives managers have largely saturated institutional markets and are now aggressively targeting the wealth channel, creating both opportunities and risks for individual investors.

Sep 14, 20253 min read

Apollo's Zelter Sees Historic Private Credit Expansion Ahead

Apollo Global Management identifies a massive shift underway in fixed income markets, predicting that private credit will expand from $1.5 trillion to $40 trillion by decade's end as institutional investors seek yield beyond traditional public markets.

Sep 13, 20253 min read

Private Market Fees May Hinder Mainstream Adoption, Morningstar CEO Says

The convergence of public and private markets is accelerating, but fees in semi-liquid private market vehicles are currently three times higher than typical mutual funds—creating a steep hurdle that threatens widespread adoption. Kunal Kapoor, CEO of Morningstar, warns that without dramatic fee compression, the industry's mainstream ambitions will stall despite growing investor interest.

Sep 12, 20253 min read

Nordic Capital's Healthcare Investment Strategy Shifts

Healthcare costs now consume up to 20% of U.S. GDP and are growing at twice the rate of inflation, creating what one private equity executive calls a "national security issue" that threatens America's spending power on defense and other priorities. Daniel Berglund, Head of U.S. and Co-Head of Healthcare at Nordic Capital, argues that this unsustainable trajectory demands a fundamental shift toward technology-driven solutions and value-based care models.

Sep 11, 20253 min read

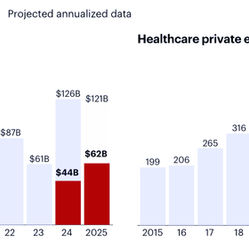

Healthcare PE Deals Slow as Tariffs Dampen Investor Appetite, Bain Report Shows

Healthcare PE deals slow amid tariff fears, but AI-driven IT assets surge as investors seek policy-insulated growth opportunities.

Sep 9, 20252 min read

US Tariffs Hit Near-Century High, Disrupt Private Markets, PitchBook Analysis Shows

US tariff surge to 100-year high disrupts private markets recovery as exit drought persists despite macro support.

Sep 7, 20252 min read

UK Private Capital Shows Resilience Despite Exit Challenges

UK private capital adapts to exit constraints with US investment surge and secondary market growth reshaping liquidity strategies.

Sep 7, 20252 min read

Private Credit Enters Adolescence as Market Tests Resilience

Private credit's $3 trillion market faces first major test as discipline separates winners from losers in maturing cycle.

Sep 7, 20253 min read

Infrastructure Investing Evolution And Value Creation Strategies

Infrastructure investing has evolved beyond passive ownership to require operational intensity and network-building capabilities.

Sep 5, 20253 min read

AI Poised to Transform Private Markets Investment Strategies

AI will transform private markets like Bloomberg did bonds—operational efficiency today, new investment strategies tomorrow.

Aug 31, 20252 min read

Alternative Asset Managers Embrace Insurance in $1 Trillion Transformation

Asset managers acquire $1T in insurance products, transforming from episodic fundraising to permanent capital with lower valuations.

Aug 28, 20253 min read

Private Equity Giants Surge Despite Economic Uncertainty Per Pitchbook Analysis

What's New According to PitchBook's Q2 2025 US Public PE and GP Deal Roundup , major private equity firms deployed $21 billion in...

Aug 28, 20252 min read

Private Equity's Healthcare Problem Gets Worse

Private equity firms are facing mounting evidence that their healthcare investments prioritize profits over patients, with new investigations revealing dangerous practices at hospitals from Massachusetts to Pakistan.

Aug 26, 20252 min read

bottom of page