top of page

The definitive source of private markets intelligence.

Nordic Capital's Healthcare Investment Strategy Shifts

Healthcare costs now consume up to 20% of U.S. GDP and are growing at twice the rate of inflation, creating what one private equity executive calls a "national security issue" that threatens America's spending power on defense and other priorities. Daniel Berglund, Head of U.S. and Co-Head of Healthcare at Nordic Capital, argues that this unsustainable trajectory demands a fundamental shift toward technology-driven solutions and value-based care models.

Sep 113 min read

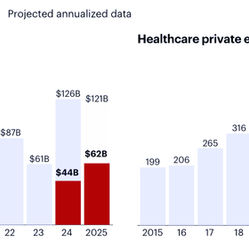

Healthcare PE Deals Slow as Tariffs Dampen Investor Appetite, Bain Report Shows

Healthcare PE deals slow amid tariff fears, but AI-driven IT assets surge as investors seek policy-insulated growth opportunities.

Sep 92 min read

US Tariffs Hit Near-Century High, Disrupt Private Markets, PitchBook Analysis Shows

US tariff surge to 100-year high disrupts private markets recovery as exit drought persists despite macro support.

Sep 72 min read

UK Private Capital Shows Resilience Despite Exit Challenges

UK private capital adapts to exit constraints with US investment surge and secondary market growth reshaping liquidity strategies.

Sep 72 min read

Private Credit Enters Adolescence as Market Tests Resilience

Private credit's $3 trillion market faces first major test as discipline separates winners from losers in maturing cycle.

Sep 73 min read

Infrastructure Investing Evolution And Value Creation Strategies

Infrastructure investing has evolved beyond passive ownership to require operational intensity and network-building capabilities.

Sep 53 min read

AI Poised to Transform Private Markets Investment Strategies

AI will transform private markets like Bloomberg did bonds—operational efficiency today, new investment strategies tomorrow.

Aug 312 min read

Alternative Asset Managers Embrace Insurance in $1 Trillion Transformation

Asset managers acquire $1T in insurance products, transforming from episodic fundraising to permanent capital with lower valuations.

Aug 283 min read

Private Equity Giants Surge Despite Economic Uncertainty Per Pitchbook Analysis

What's New According to PitchBook's Q2 2025 US Public PE and GP Deal Roundup , major private equity firms deployed $21 billion in...

Aug 282 min read

Private Equity's Healthcare Problem Gets Worse

Private equity firms are facing mounting evidence that their healthcare investments prioritize profits over patients, with new investigations revealing dangerous practices at hospitals from Massachusetts to Pakistan.

Aug 262 min read

European VC Valuations Hit Multi-Year Highs Amid Mixed Signals, PitchBook Analysis Shows

According to PitchBook's Q2 2025 European VC Valuations Report, median venture capital valuations across Europe continued climbing in the first half of 2025, with Series E+ companies reaching €1.2 billion for the first time since 2022. The value-over-volume dynamic persisted as deal counts remained flat while median deal sizes and valuations grew across most funding series, though volatility in financial markets and geopolitical tensions created uncertainty for the second hal

Aug 252 min read

PE Secondary Market Hits Record $160B as Liquidity Drought Persists, StepStone Says

The private equity secondary market shattered records in 2024, reaching $160 billion in transaction volume as limited partners and general partners turned to alternative liquidity solutions amid a prolonged distribution drought. According to StepStone Group's August 2025 report, the first half of 2025 has already seen $102 billion in transactions, putting the market on track to break last year's record again.

Aug 232 min read

Morningstar CEO Warns on Private Markets Complexity

Morningstar CEO Kunal Kapoor, speaking at the 2025 Morningstar Investment Conference in Chicago, outlined how his firm is responding to this fundamental shift by extending its analytical framework to cover private investments.

Aug 233 min read

Alaska Permanent Fund CIO Warns Private Markets Have Lost Their Edge

Alaska's $85B fund CIO warns private market premiums have vanished as valuations soar beyond historical norms.

Aug 223 min read

Private Markets Face AI Revolution While Stuck in Spreadsheets

Private markets' spreadsheet-based infrastructure will be fully automated by AI within years, not decades.

Aug 223 min read

Energy Transition Hits Sweet Spot for Private Equity Returns

The energy transition sector has evolved from a high-risk merchant market to a predictable fee-generating opportunity, creating what could be a decade-long investment window before large infrastructure players drive down returns to uninvestable levels. Chris Rozzell, managing partner at Cresta Fund Management, brings a rare founder-operator perspective to middle-market private equity, having grown Regency Energy Partners from $100 million to multi-billion dollar enterprise va

Aug 223 min read

Why Smart LPs Back Early-Stage Venture

Jamie Rhode, Partner at Screendoor, a venture fund-of-funds that exclusively backs institutional-grade emerging managers, joined Balentic CEO Kasper Wichmann on Balentic Edge to discuss why traditional LP thinking about early-stage venture is fundamentally flawed.

Aug 193 min read

Private Equity Must Evolve Beyond Financial Engineering, THL Partners CEO Says

Todd Abbrecht, Co-CEO of THL Partners, argues that the industry's future success depends on deep domain expertise and integrated operational capabilities rather than deal-making prowess alone.

Aug 193 min read

Venture Capital Outsider Built Billion-Dollar Seed Fund

Ramtin Naimi, founder of Abstract Ventures, argues that traditional seed funds are largely delusional about their deal flow advantages and that multi-stage tier-one firms consistently outperform at seed investing.

Aug 193 min read

Ares CEO: Private Markets Thrive Despite Subdued M&A Volumes

Michael Arougheti, CEO of Ares Management, which oversees $570 billion in assets, appeared on Bloomberg Surveillance following the firm's Q2 2025 earnings call to discuss how alternative asset managers are navigating this environment. His firm deployed $27 billion in the quarter despite subdued deal activity, highlighting how the industry has evolved beyond traditional M&A dependency to encompass digital infrastructure, real estate, private credit, and asset-based finance acr

Aug 193 min read

bottom of page