top of page

The definitive source of private markets intelligence.

Sixth Street CEO: AI Transition Risk and Investment Evolution

Alan Waxman warns that the financial system faces significant overlooked risks from AI's productivity transition, citing insufficient discussion about job displacement and economic rebalancing as artificial intelligence reshapes entire industries.

Jul 243 min read

Blackstone Posts Record $1.2T AUM as Fee Earnings Surge 31% Despite Muted Dealmaking

Blackstone reported outstanding Q2 2025 results with distributable earnings of $1.6 billion ($1.21/share), up 25% year-over-year, while fee-related earnings surged 31% to $1.5 billion. Assets under management hit a record $1.2 trillion, up 13% YoY, driven by $52 billion in quarterly inflows and strong performance across private credit, infrastructure, and private wealth platforms despite a muted realization environment.

Jul 244 min read

Private Credit Prepares for Deal Surge as Market Bottleneck Eases

The private credit market is sitting on massive piles of capital while waiting for a significant backlog of deals to emerge once market volatility settles, creating what could be an explosive growth period for direct lenders.

Jul 194 min read

Yale Private Markets Investment Chief Warns of Permanent Return Decline

The private equity and venture capital industry faces a fundamental reckoning as the strategies that generated extraordinary returns over the past four decades become increasingly difficult to replicate, according to Tim Sullivan, who recently retired after overseeing Yale University's private market portfolios for 39 years. Sullivan warns that institutions must dramatically lower their return expectations as the industry has become overcrowded, overfunded, and efficiently pr

Jul 194 min read

Private Credit Defends Against Peak Predictions

Mike Dennis discusses how private credit proves resilient despite peak predictions, with middle-market focus offering protection from competition.

Jul 193 min read

Private Credit Market Far From Peak, Set For Massive Growth

The private credit market is nowhere near its peak despite recent warnings from major bank executives, and is instead positioned for explosive growth that could see it reach $15 trillion within a decade—matching the size of public credit markets.

Jul 183 min read

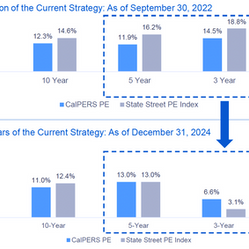

CalPERS PE Strategy Overhaul Delivers Top Returns

CalPERS Private Equity has achieved a stunning performance turnaround, catapulting from 17th place in 2022 to the top performer among America's 30 largest public pension fund private equity programs in 2024.

Jul 163 min read

Private Equity's Continuation Fund Surge Raises Quality Concerns

Private equity's continuation fund market is experiencing explosive growth, with these vehicles now representing 13% of global PE exits in 2024, up from just 5% in 2021, according to investment bank Jefferies data reported by The Wall Street Journal. However, industry experts warn that as firms increasingly use these tools to extend asset ownership and provide liquidity to cash-starved investors, the real test lies not just in providing liquidity but in maintaining asset qual

Jul 143 min read

JPMorgan Enters Private Credit Despite Dimon's Warning, WSJ Reports

JPMorgan Chase CEO Jamie Dimon is diving headfirst into the private credit market with a $50 billion commitment, despite publicly comparing the fast-growing sector to the risky lending practices that sparked the 2008 financial crisis, according to The Wall Street Journal. The nation's largest bank is racing to compete with unregulated lending giants like Blackstone and Ares Management that have dominated this space for over a decade.

Jul 143 min read

KKR's Freise on Managing Through Multiple Market Cycles

Philipp Freise, Co-Head of European Private Equity at KKR and manager of Europe's largest private fund at $8 billion, argues that the current hangover from 2021's artificial liquidity surge is cyclical rather than structural, though resolution requires fundamental changes to how capital flows to individual investors.

Jul 133 min read

European PE Market Stalls as Trump Tariff Threats Disrupt Deal Flow, PitchBook Report Shows

European private equity deal value dropped 10.5% quarter-over-quarter in Q2 2025 as sponsors worldwide hit the pause button following US President Donald Trump's tariff announcements in April. According to PitchBook's European PE Breakdown, the market showed resilience in deal count, which rose 3.1% QoQ, thanks to a pickup in activity toward quarter-end as European central banks maintained monetary easing trajectories.

Jul 132 min read

Emerging Managers Debate Scale vs. Specialization Strategy

The venture capital ecosystem is grappling with fundamental questions about optimal fund sizing as emerging managers weigh the benefits of scaling operations against maintaining focused specialization strategies. The entire Screendoor team—Lisa Cawley, Layne Johnson, and Jamie Rhode—joined the Superclusters podcast to address critical questions from three emerging GPs about LP motivations, venture transparency, and scaling decisions.

Jul 133 min read

Specialist VCs Outpace Generalists in Key Metrics Despite Returns Convergence

Specialist VCs drive higher valuations and faster exits but fund returns converge with generalists, reshaping investment strategies.

Jul 132 min read

PitchBook's Private Markets Benchmarks Show Mixed Q1 Performance Amid Global Uncertainty

According to PitchBook's Global Benchmarks report, private capital markets delivered a modest 0.47% return in Q1 2025, with significant divergence across asset classes as venture capital posted negative returns while private debt led performance gains.

Jul 132 min read

LP of GPs Model Redefines Emerging Manager Access

The venture capital ecosystem is witnessing a fundamental transformation as innovative fund structures emerge to bridge the gap between institutional LPs and emerging managers, creating new pathways for accessing top-tier talent while they're still building their firms. Lisa Cawley, Managing Director of Screendoor, reveals how the "LP of GPs" model is revolutionizing early-stage fund investing by combining allocator expertise with seasoned GP advisory support.

Jul 133 min read

Private Credit Secondaries Leader Sees Disruption Ahead

Private credit secondaries are experiencing explosive growth as the broader $1.7 trillion private credit market creates unprecedented liquidity demands, with deal flow surging from $5-7 billion five years ago to $36 billion in 2024. Rick Jain, Partner and Global Head of Private Credit at Pantheon, warns that while opportunities abound, the market faces potential disruption from mounting macroeconomic uncertainty and overconfidence in current pricing.

Jul 123 min read

Software Investing Demands Organic Growth Over Financial Engineering, Says Seasoned Investor

Private equity firms must fundamentally shift from financial engineering to backing businesses with genuine organic growth as higher interest rates eliminate traditional return drivers like leverage and multiple arbitrage. Nic Humphries, Senior Partner and Executive Chairman of Hg, demonstrates how three decades of focused software investing has built Europe's second-largest technology conglomerate by prioritizing customer value over financial manipulation.

Jul 123 min read

European Software Specialist Builds Billion-Euro Private Wealth Business

Private equity is experiencing a fundamental shift as specialized firms demonstrate that focused expertise can drive superior returns while building scalable wealth management businesses. Martina Sanow, Partner and Head of HG Wealth at the $85 billion software-focused private equity firm HG, reveals how a European specialist has built one of the continent's most successful evergreen fund strategies.

Jul 123 min read

Evergreen Funds Transform Private Market Access

Private markets are experiencing a structural shift as evergreen fund structures democratize access to previously exclusive investments, with industry veterans warning that despite rapid growth, the space remains in its early innings.

Jul 123 min read

Private Markets Shift to Retail as Institutional Flows Slow While Managing Risk Concerns | Weekly Pulse

Private markets pivot to retail investors as institutional capital slows, while firms push higher leverage ratios to compete. Major fundraising milestones include Haveli's record $4.5B debut fund and iCapital's $820M raise. Banks fight PE talent poaching with new policies. Global PE deal value up 18.7% to $386B in H1 despite fewer transactions.

Jul 124 min read

bottom of page