Private Equity Giants Outperform Their Own Funds by A Wide Margin

- Aug 4, 2025

- 3 min read

What's New

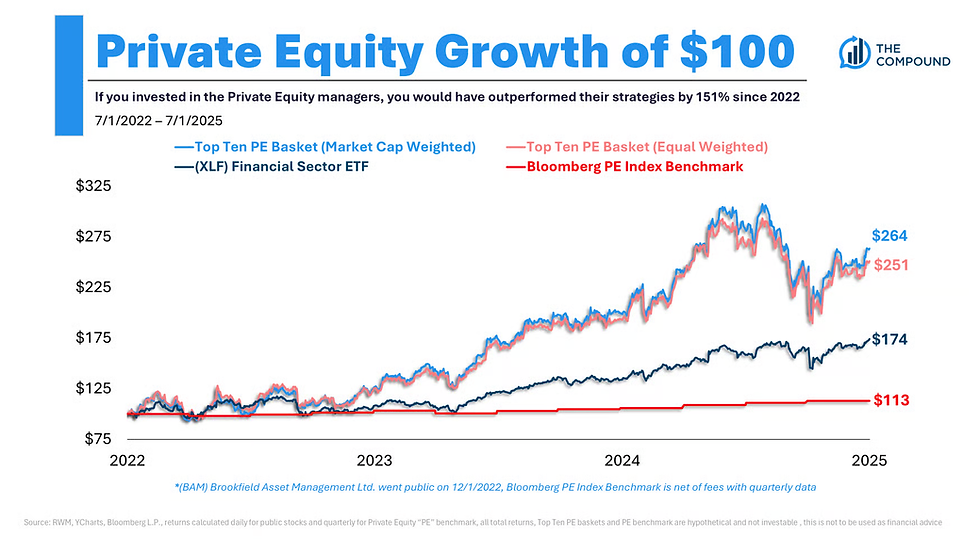

Private equity firms are generating massive returns for shareholders while their own investment products lag significantly behind. According to Josh Brown's analysis, the ten largest PE companies delivered a median 31% annualized return since 2022, while Bloomberg's PE Index returned just 4% annually over the same period—creating a stark 151% performance gap that challenges conventional wisdom about alternative investments.

Why It Matters

This performance divergence exposes a fundamental shift in wealth creation within private markets. As retail investors pour billions into PE funds through new "democratized" platforms, the real winners are the fund management companies themselves, not the investors paying hefty fees for underperforming products. This dynamic could reshape how sophisticated investors approach alternative asset exposure.

Big Picture Drivers

Fee Migration: Wall Street pivots from low-margin ETFs to high-fee private funds as active mutual fund performance continues disappointing

Retail Democratization: Platforms like iCapital and major brokerages now offer PE access to investors with just $75K-$100K minimums

Regulatory Tailwinds: Trump administration preparing executive orders to open 401(k) plans to private equity investments

Distribution Explosion: Financial advisors increasingly pitch PE as sophisticated portfolio diversification amid sky-high public market valuations

Liquidity Solutions: "Evergreen" and interval fund structures provide semi-liquid wrappers for traditionally illiquid investments

By The Numbers

$375 billion: Assets in semi-liquid "evergreen" private market funds targeting retail investors

17%: Retail share of private market fundraising in 2024, a new record

25%: Percentage of US financial advisors now using private credit in client portfolios

3X increase: Growth in retail-focused private equity fund subscriptions during 2023-2024

$8 trillion: Untapped 401(k) market that could allocate 5% ($400B) to private funds

Key Trends to Watch

Major platforms like Fidelity and Schwab are rapidly scaling retail private market access with lower minimum investments.

Vanguard's surprising entry into private markets through HarbourVest partnership signals mainstream acceptance of alternative investments.

Interval funds have exploded 10X since 2017, reaching $40 billion as investors seek liquid private market exposure.

Model portfolios used by financial advisors have increased private market allocations 5X since 2020, fundamentally changing asset allocation approaches.

Key Quotes

Democratization Pitch: "Up until now, an ordinary millionaire like you has never had the ability to tap into these asset classes" - Shows how firms market exclusive investments to wealthy retail investors.

House Advantage: "I would rather bet on the bettors placing their bets than on the outcome of the bets themselves" - Brown's core thesis for owning PE management companies instead of their funds.

Industry Momentum: "You can fight it, but you will be run over. There are too many layers of people and platforms and dollars all rowing in the same direction" - Describes the unstoppable force driving private market adoption across wealth management.

Complexity Warning: "If selecting stock mutual funds is chess, private equity is a 12-sided Rubik's Cube" - Brown cautions investors about the added complexity of due diligence in private markets.

Vegas Analogy: "In Vegas, they refer to this as being the house" - Explains why owning PE management companies beats investing in their products, drawing a direct parallel to casino economics.

The Wrap

Smart money is betting on the house rather than playing the game. While private equity funds deliver mediocre returns after fees, owning shares in PE management companies has proven dramatically more profitable. As this $100 trillion addressable market continues expanding into retail channels, investors might consider following the general partners' lead by becoming shareholders in the management companies rather than limited partners in their funds.

Comments