top of page

The definitive source of private markets intelligence.

Private Equity Managers Have Earned Over $1 Trillion in Carried Interest

According to a recent academic study by Ludovic Phalippou, Professor of Financial Economics at Oxford University's Saïd Business School, private capital fund managers have accumulated more than $1 trillion in carried interest—the performance-based compensation known as "carry"—from funds raised between 2000 and 2019.

Nov 3, 20254 min read

Private Capital Returns Flatten Amid Market Uncertainty in Q2 2025, PitchBook

According to PitchBook's Q2 2025 Private Capital Indexes report, private capital delivered a near-flat return of just 0.1% in the second quarter, marking a significant deceleration from the 1.0% gain in Q1. The slowdown was driven by a notable -1.1% decline in private equity, while venture capital rebounded with a 2.7% return. Direct lending surged 8.0% for the quarter, and funds of funds jumped 6.1%, reflecting diverging fortunes across asset classes as market conditions rem

Nov 2, 20253 min read

Private Markets at a Crossroads as Retail Push Collides With Quality Concerns | Weekly Pulse

Private markets face a critical moment as the rush to open alternative investments to retail investors collides with mounting concerns over credit quality, transparency, and regulatory oversight. BDC stocks are plunging, dividends are being cut for the first time, and high-profile bankruptcies are exposing risks in the $1.7 trillion sector.

Oct 11, 20256 min read

Private Markets Surge Amid Structural Shifts | Weekly Pulse

Must Know: Record Deal Activity Signals Private Markets Renaissance Bottom Line: Electronic Arts' $55 billion leveraged buyout—the...

Oct 4, 20256 min read

AI Drives Private Equity's Next Competitive Edge

Private equity faces mounting pressure to deliver returns after years of overpriced deals and sluggish exits, forcing firms to fundamentally rethink how they create value in an increasingly competitive landscape. Clark O'Neill, BCG's global lead for AI infrastructure and cyber in the private investors and private equity practice, argues that artificial intelligence has moved beyond theoretical potential to become a practical necessity for differentiated returns.

Oct 2, 20253 min read

Private Markets Show Signs of Recovery as Exit Activity Picks Up, Schorr Says

Alternative asset managers are experiencing their highest levels of optimism about exit activity and IPO markets since before the 2022 rate hikes, with several industry leaders signaling that the pause in activity is behind them. Glenn Schorr, senior managing director and senior research analyst at Evercore ISI who has covered alternative asset managers since the first firms went public.

Sep 27, 20253 min read

Private Credit's Hidden Opportunities and Market Risks

The private credit market has evolved into a $1.7 trillion asset class that Ben Radinsky warns is increasingly becoming "beta" - essentially market performance rather than alpha generation. As traditional direct lending grows more competitive with deteriorating terms, the real opportunities lie in what he calls "beautifully inefficient" markets where capital has fled due to regulatory changes or misunderstood complexity.

Sep 26, 20253 min read

Private Credit's Golden Age Persists Despite Market Doubts

According to Hamilton Lane's latest market outlook, private credit investors remain positioned for sustained higher yields as interest rates stay elevated for longer than previously expected, dispelling concerns that the asset class's golden age may be ending. The firm's analysis reveals a significant supply-demand imbalance with a $2 trillion funding gap through 2028, supporting continued strong performance despite recent market volatility.

Sep 21, 20252 min read

Venture Capital's Defense Boom Faces Return Reality Check

Defense technology venture capital investment has surged from $1 billion in 2020 to $7 billion in 2024, creating what appears to be the industry's next major theme after AI's recent dominance. However, veteran investor Alex van Someren warns that venture capital remains "one of the hardest ways to make money" and cautions against the herd mentality that periodically drives stampedes toward fashionable sectors.

Sep 18, 20253 min read

PE Secondary Market Hits Record $160B as Liquidity Drought Persists, StepStone Says

The private equity secondary market shattered records in 2024, reaching $160 billion in transaction volume as limited partners and general partners turned to alternative liquidity solutions amid a prolonged distribution drought. According to StepStone Group's August 2025 report, the first half of 2025 has already seen $102 billion in transactions, putting the market on track to break last year's record again.

Aug 23, 20252 min read

Alaska Permanent Fund CIO Warns Private Markets Have Lost Their Edge

Alaska's $85B fund CIO warns private market premiums have vanished as valuations soar beyond historical norms.

Aug 22, 20253 min read

Private Equity Must Evolve Beyond Financial Engineering, THL Partners CEO Says

Todd Abbrecht, Co-CEO of THL Partners, argues that the industry's future success depends on deep domain expertise and integrated operational capabilities rather than deal-making prowess alone.

Aug 19, 20253 min read

Private Markets Grapple With Transparency & Disclosure Concerns Amid 401(k) Push | Weekly Pulse

Private markets face transparency scrutiny as Partners Group obscures $16B fund data with incomprehensible disclosures. Payment deferrals hit 11.4% while firms raise $9B+ across midlife co-investments, software deals & carve-outs. New student loan limits create private credit opportunities as industry navigates valuation concerns amid growth.

Aug 15, 20254 min read

Carnegie Mellon's $4B Investment Chief Warns of Venture Capital Crisis

The venture capital industry faces a fundamental crisis where 90% of limited partners shouldn't be investing in the asset class, according to analysis showing median returns barely exceed 8% while top-quartile funds struggle to beat public market equivalents. Miles Dieffenbach, Managing Director of Investments at Carnegie Mellon University, shared this stark assessment on Harry Stebbings' 20VC podcast, drawing from his experience overseeing a $4 billion endowment.

Aug 10, 20253 min read

TPG Declares Record Dividend as Credit Platform Reaches Inflection Point, Posting 26% Earnings Growth

TPG delivered outstanding Q2 2025 results with after-tax distributable earnings of $268 million ($0.69 per share), up 26% year-over-year, driven by record-breaking fundraising of $11.3 billion—the second highest quarter in company history.

Aug 10, 20254 min read

Private Markets Embrace Policy Shifts as 401(k) Access and Regulatory Scrutiny Reshape Industry Dynamics | Weekly Pulse

Private markets face regulatory crossroads as Trump's 401(k) order promises $12.5T access while Warren scrutinizes $1.7T credit sector. Industry splits on growth outlook with Dimon warning of peaks vs. private credit leaders seeing continued expansion. Major deals include Reckitt's $4.8B sale to Advent.RetryClaude can make mistakes. Please double-check responses.

Jul 19, 20254 min read

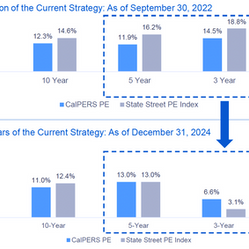

CalPERS PE Strategy Overhaul Delivers Top Returns

CalPERS Private Equity has achieved a stunning performance turnaround, catapulting from 17th place in 2022 to the top performer among America's 30 largest public pension fund private equity programs in 2024.

Jul 16, 20253 min read

Vantager Brings AI-Native Infrastructure to Private Market Allocators

Vantager launches to modernize how Limited Partners assess and act on private market fund data—delivering structure, speed, and strategic insight through AI.

Jul 15, 20253 min read

Private Equity's Continuation Fund Surge Raises Quality Concerns

Private equity's continuation fund market is experiencing explosive growth, with these vehicles now representing 13% of global PE exits in 2024, up from just 5% in 2021, according to investment bank Jefferies data reported by The Wall Street Journal. However, industry experts warn that as firms increasingly use these tools to extend asset ownership and provide liquidity to cash-starved investors, the real test lies not just in providing liquidity but in maintaining asset qual

Jul 14, 20253 min read

European PE Market Stalls as Trump Tariff Threats Disrupt Deal Flow, PitchBook Report Shows

European private equity deal value dropped 10.5% quarter-over-quarter in Q2 2025 as sponsors worldwide hit the pause button following US President Donald Trump's tariff announcements in April. According to PitchBook's European PE Breakdown, the market showed resilience in deal count, which rose 3.1% QoQ, thanks to a pickup in activity toward quarter-end as European central banks maintained monetary easing trajectories.

Jul 13, 20252 min read

bottom of page